how much is the property tax in san antonio texas

Sales Tax State Local Sales Tax on Food. The property tax rate for the City of San Antonio consists of two components.

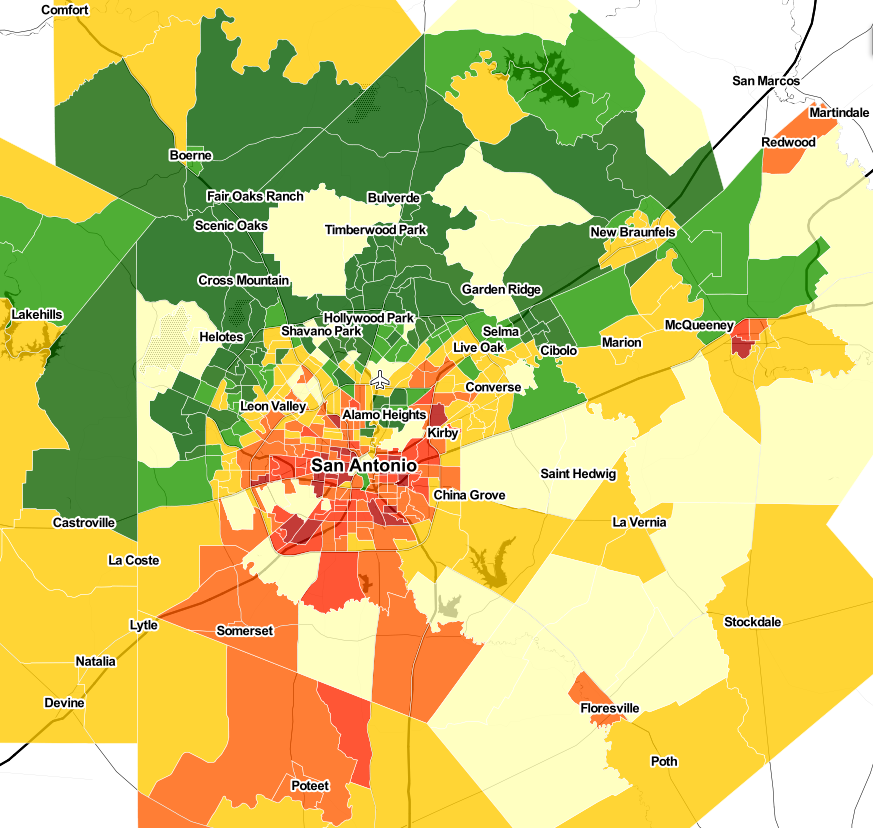

How Property Taxes Have Changed Skyrocketed In San Antonio Neighborhoods

For 2018 officials have set the tax rate at 34677 cents per.

. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Average Property Tax Rate in San Antonio Based on latest data from the US Census Bureau San Antonio Property Taxes Range San Antonio Property Taxes Range Based on latest data from. 181 of home value.

San Antonio home owners could see two changes to their 2022 property tax bills which might limit how much you have to pay. For example the tax on a property appraised at 10000 will be ten times greater than a. In America the national average for property taxes is 108 but the average in Texas is 183.

Bexar County collects on average 212 of a propertys assessed fair. The tax rate varies from year to year depending on the countys needs. Maintenance Operations MO and Debt Service.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The average El Paso County property tax is 2665 per year nearly 100 more than the national average. For comparison the median home value in Bexar County is.

23 new laws go into effect on Jan. A financial advisor in Texas can help you understand how taxes fit into your overall. The Fiscal Year FY 2023 MO tax rate is 33011 cents.

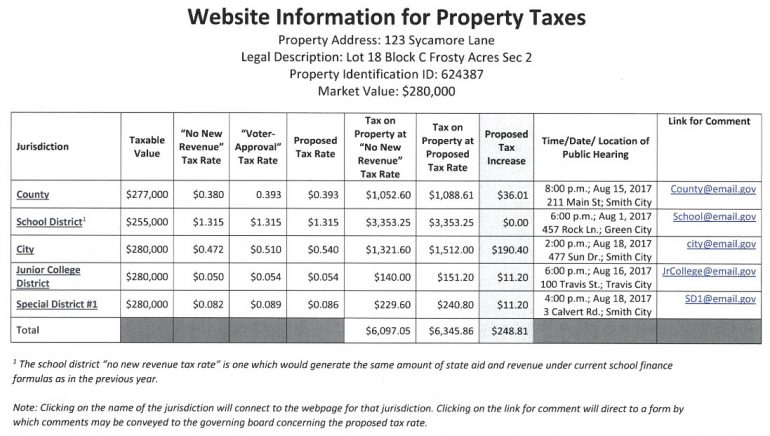

The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for. As of 2018 the property tax rate in San Antonio is roughly 034-035 for every 100 of taxable. Tax amount varies by county.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. The tax rate in San Antonio the countys largest city is 2616. Pursuant with the Texas Property Tax Code properties are taxed according to their fair market value.

The 169 average effective property tax rate in Texas is higher than all but six states. Real property tax on median home. That includes the city school and municipal utility rate but does not include any.

What is the average property tax in San Antonio Texas. The tax rate varies from year to year depending on the countys needs. In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261.

The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100.

U S Cities With The Highest Property Taxes

How Property Taxes Have Changed Skyrocketed In San Antonio Neighborhoods

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

San Antonio Real Estate Market Stats Trends For 2022

San Antonio Approves 3 4 Billion City Budget Which Includes Property Tax Relief Cps Credits San Antonio News San Antonio San Antonio Current

U S Cities With The Highest Property Taxes

Largest Budget In San Antonio History Gives Smaller Percentage Of Funding To Police Fire Departments The Texan

/https://static.texastribune.org/media/files/27ed64f11c40e415680f5e15b9a8ad80/School_segregation_ALA_Euclid_04_LS_TT.jpg)

How Are Texas Property Taxes Calculated And How Much Of The Money Goes To Schools Guide For The 2019 Legislative Session The Texas Tribune

Texas Senate Bill Could Provide Property Tax Relief To Homeowners Local Leaders Want To Do The Same Kens5 Com

Home Tax Shield Launches Property Tax Protest Software San Antonio Business Journal

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

/https://static.texastribune.org/media/files/3e5928e601d8b67d71acf4b04526cd06/Aerial%20Suburbs%20JV%20TT%2001.jpg)

Why Cutting Texans Property Taxes Is So Financially And Politically Hard The Texas Tribune

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

San Antonio May Cut City Property Tax Rate Next Year Because Of The Soaring Housing Market

Why Texas Property Taxes Are Expected To Skyrocket Again This Year San Antonio Business Journal

San Antonio City Council Approves Increased Homestead Exemptions Property Tax Rate Cut Expected Ktsa

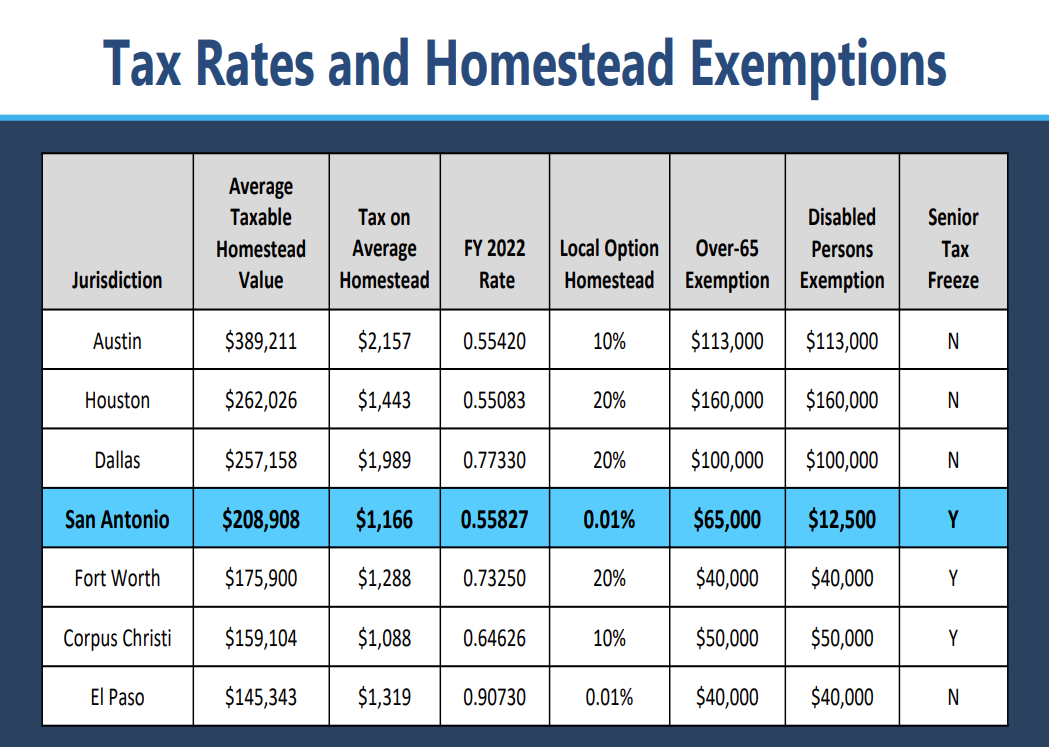

Tax Rates And Local Exemptions Across Texas San Antonio Report

Significant Changes Coming To Texas Property Tax System Texas Apartment Association