what is the sales tax in wyoming

How much is sales tax in Wyoming. The state also has several special local and excise taxes.

Sales Tax By State Is Saas Taxable Taxjar

At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2.

. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935. In addition to taxes car purchases in Wyoming may be. Tax rate charts are only updated as changes in rates occur.

181 rows There are a total of 106 local tax jurisdictions across the state collecting an average. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. The base state sales tax rate in Wyoming is 4.

In Cheyenne for example the county tax rate is 1 for Laramie County resulting in a total tax rate of 5. The state sales tax rate in Wyoming is 4. Wyoming is the best place to live when it comes to taxes.

Wyoming has no state income tax. In addition Local and optional taxes can. Sales Use Tax Rate Charts.

If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. 31 rows Wyoming WY Sales Tax Rates by City The state sales tax rate in. Wyoming has state sales tax of 4 and allows local governments to collect a local option.

As a business owner selling taxable goods or services you act as an agent of the. Local tax rates in Wyoming range from 0 to. 104000 What is the sales tax rate in Wyoming.

Contractors must report their use tax on forms. The minimum combined 2022 sales tax rate for Cheyenne Wyoming is 6. WYOMING STATE COUNTY CITY SALES TAX RATES 2021 Register Online This page lists an outline of the sales tax rates in Wyoming.

For example lets say that you want to purchase a new car for 30000 you would use. You have to get the sales tax at the tax rate where the parcel of the item reached. The minimum combined 2022 sales tax rate for Casper Wyoming is.

What is the sales tax in Wyoming 2021. In the state of Wyoming sales tax is legally required to be collected from all tangible physical products being sold to a consumer and certain services are taxed as well. Businesses licensed under the Wyoming sales tax laws must report use tax on their sales tax return forms ETS Form 41-1 or 42-1 and 42-2.

Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. Currently combined sales tax rates in Wyoming range from 4 to 6 depending on the location of the sale. Should you collect sales tax on shipping charges in Wyoming.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Wyomings sales tax is 4 percent. Please refer to the following links if you are a.

Provide bulletins publications and other educational material to address commonly asked questions Did You Know. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Wyoming local counties cities and special taxation. The Wyoming sales tax rate is currently.

State wide sales tax is 4. So if you are going to become a resident of Wyoming sales tax collection is complicated. Groceries and prescription drugs are exempt from the Wyoming sales tax Counties and.

This is the total of state county and city sales tax rates. And if we talk about the sales tax in Wyoming it is the destination-based sales tax state. The Wyoming sales tax rate is currently 4.

You can calculate the sales tax in Wyoming by multiplying the final purchase price by 04. This is the total of state county and city sales tax rates. Cities counties and other municipalities may also have additional taxes related to retail sales.

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from. You can look up the local sales tax rate with TaxJars Sales Tax Calculator.

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Wyo Property Tax Rates Rank Right At The Bottom

What Are Estimated Taxes And Do I Have To Pay Them Wyoming Small Business Development Center Network

Wyoming Certificate Of Authority Foreign Wyoming Corporation

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Senate Approves Giving Cities Option For Extra 7th Penny Sales Tax Local Jhnewsandguide Com

No Hike In Wyoming S Sales And Use Taxes For Now

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Wyoming Taxes Wy State Income Tax Calculator Community Tax

Bill Of Sale Form Wyoming Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Wyoming Sales Tax Quick Reference Guide Avalara

Fillable Online Wyoming Sales Use Tax Statement Fax Email Print Pdffiller

Wyoming Vehicle Sales Tax Fees Calculator Find The Best Car Price

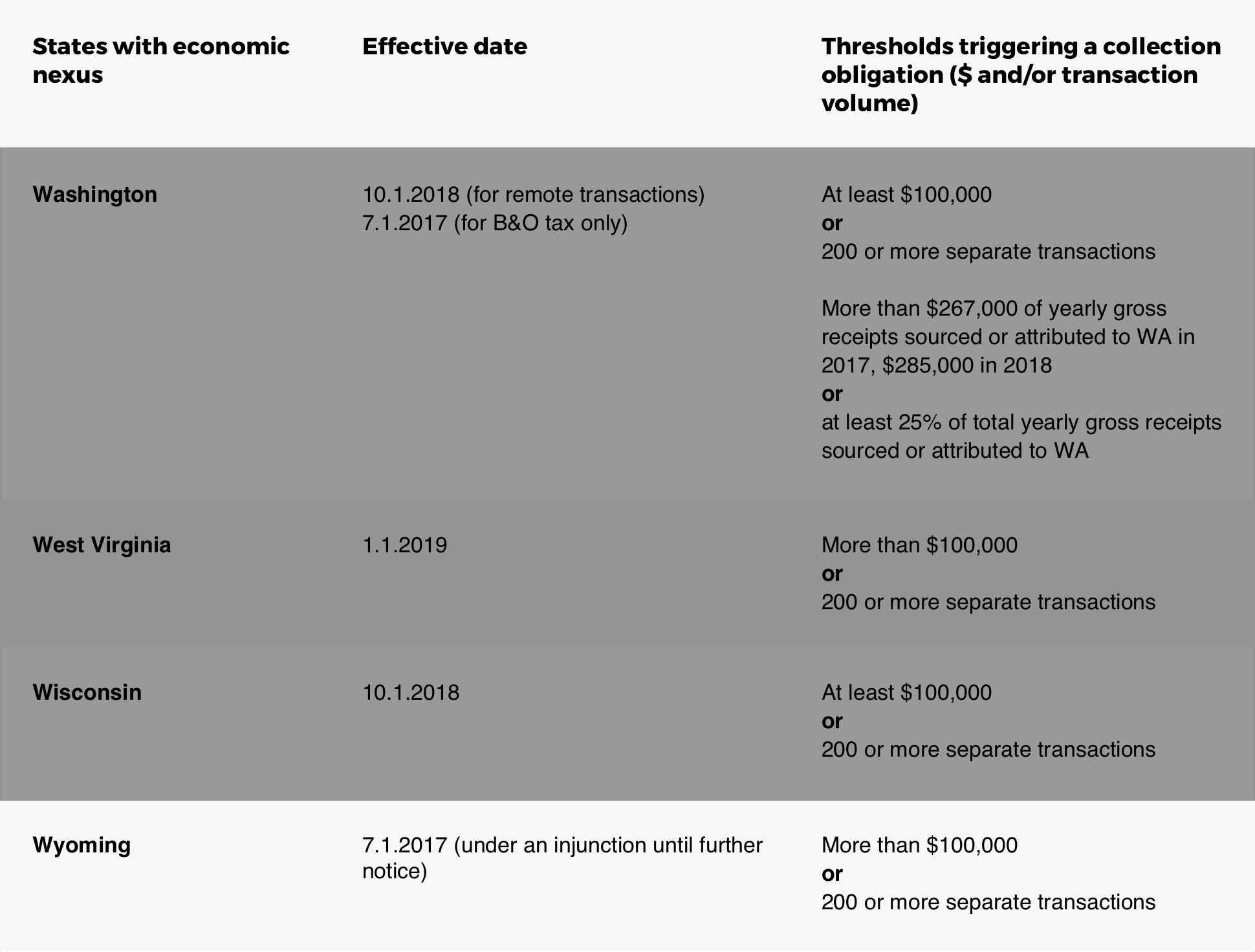

New Wyoming Online Sales Tax Rules

Wyoming Changes Sales Tax Rules For Remote Sellers

Sales Tax Laws By State Ultimate Guide For Business Owners

Pay On Line Uinta County Wy Official Website

Wyoming Income Tax Calculator Smartasset

State Government Tax Collections Pari Mutuels Selective Sales Taxes In Wyoming 2022 Data 2023 Forecast 1992 2021 Historical